The tumultuous environment of the past couple of years has certainly introduced vulnerability into your practice’s revenue cycle. Reimbursement success emanates from a myriad of factors, but it can be tracked by a handful of standard indicators. Take the opportunity to measure three key performance indicators to keep your practice on track:

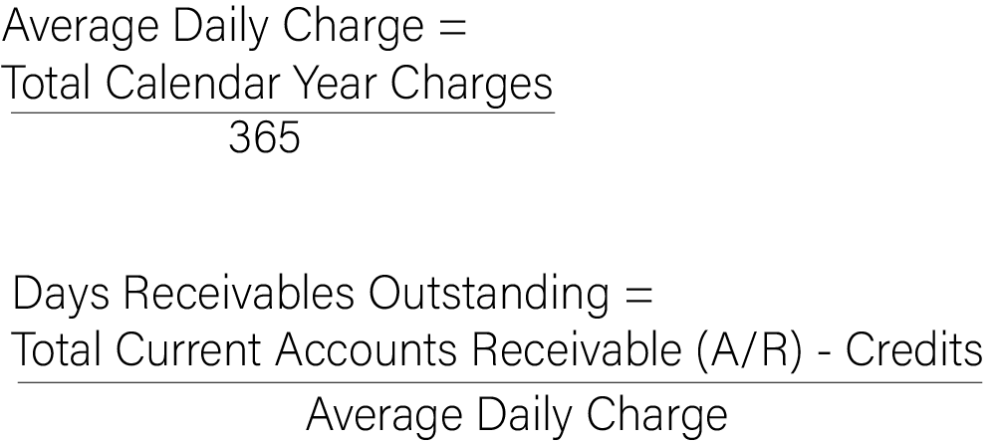

Days in receivables outstanding (DRO).

The result (DRO) should be in the range of 30 to 40. A practice with quick-processing payers like traditional Medicare may enjoy a lower number, while practices contending with Worker’s Compensation may have to tolerate a higher number. Although nothing is perfect, DRO is arguably the single best indicator of revenue cycle management (RCM) performance.

Aged trial balance (ATB). Measure your receivables outstanding based on time. Most practice management systems report an ATB based on 30-day windows – the percent of your receivables that are 0 to 30, 31 to 60, 61 to 90 days old, etc. Aging is so critical to revenue cycle management because it predicts the probability of collection. Like the DRO, an ATB is dependent on your payers’ processing times. However, overall, you should expect that less than 15% of your receivables be over 120 days. Keep in mind a few factors: time is based on the age of the receivables with a payer; once it reverts to another payer – like when you learn that BCBS has applied the balance to your patient’s deductible – the receivable moves back to zero days. That means that the ATB does not reflect when services were rendered, but rather the movement of the receivable between responsible parties. Credits – monies you owe to another party – must be excluded from the ATB to get an accurate picture of your receivables.

Accuracy. Your practice can measure accuracy based on transactions that pass through all systems and end with payment (first pass (or “clean”) claims resolution rate) or focus on those that don’t (denial rate). The former is the inverse of the latter, so either gauge of accuracy is helpful. Select a time period and measure the claims that are resolved (or denied) and divide by the total number of claims submitted. There are some nuances in the reporting of this data – like that fact that moving the responsibility for the deductible to your patient is a “resolution” even though it did not get paid. In general, however, your resolution rate should be approximately 95%, and your denial rate should be about 5%. There are valid exceptions that may cause these rates to hover at 90% and 10%, respectively –payers like Medicaid managed care organizations are more challenging from a claims processing perspective. Some payers change the rules seemingly daily, making accuracy elusive. The key is to monitor the rates, while digging into the details to discover opportunities to improve accuracy under your control.

Other revenue cycle management metrics like those in Exhibit 1 can complete the picture but start with these three to ensure that your practice is staying within the guardrails of expected performance. Monitoring these key performance indicators helps avoid surprises that can harm a practice’s revenue stream.

Exhibit 1: RCM Metrics

The contents of The Sentinel are intended for educational/informational purposes only and do not constitute legal advice. Policyholders are urged to consult with their personal attorney for legal advice, as specific legal requirements may vary from state to state and/or change over time.